Automatic offset method

If you enter invoices for expenses or asset purchases for more than one balancing segment, you might want to use Automatic Offsets to keep your Payables transaction accounting entries balanced.

If you do not use Automatic Offsets, Payables creates a single liability accounting entry for invoice transactions (if you use accrual basis accounting) and a single cash type accounting entry for payment transactions.

When you use Automatic Offsets, Payables automatically creates balancing accounting entries for your transactions. The GL account that each of the offsetting accounting entry is charged to depends on which method you use, Balancing or Account:

- Balancing. Payables builds the offsetting GL account by taking the balancing segment (usually the cost center code) from the invoice distribution and overlaying it onto the appropriate default GL account, for example the Liability account from the supplier site.

- Account. The Account method takes the opposite approach with one segment (the designated account segment) being retained from the default GL account and all other segments being retained from the invoice distribution.

- Liability

- Withholding Tax (if you apply the withheld amount at Invoice Validation time)

- Cash (if you use a pooled bank account)

- Cash Clearing (if you use a pooled bank account, and if you account for payments at clearing time)

- Discount

- Exchange Gain/Loss

- Future Dated Payment

- Rounding

- Withholding Tax (if you apply the withheld amount at Payment time)

- Bank Charges

- Bank Errors

Example

The following diagram illustrates how Payables builds a GL account on a liability distribution using the two different methods:

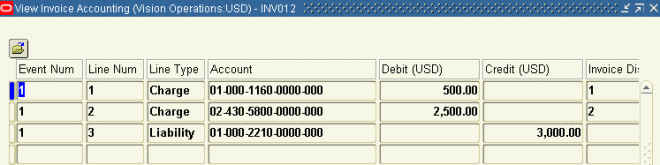

Automatic offset method : None

nvoice is cretaed with two distribution line with differnt balancing segments

Charge A/c with BS1: 01-000-1160-0000-000

Charge A/c with BS2: 02-430-5800-0000-000

Liability A/c in supplier sie: 01-000-2210-0000-000

When Accouting is done the system 'll Debit the charge A/Cs in two different balancing segments and it would credit the liability given in supplier site.

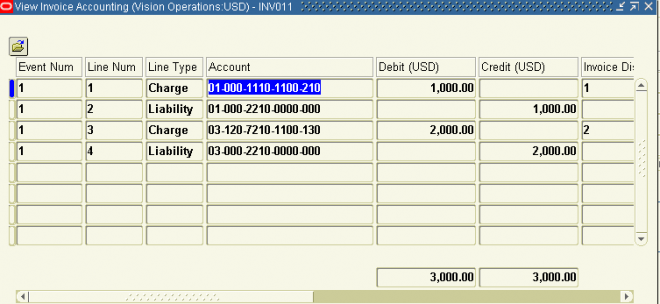

Automatic offset method : Balancing

Invoice is cretaed with two distribution line with differnt balancing segments

Charge A/c with BS1: 01-000-1110-1100-210

Charge A/c with BS2: 03-120-7210-1100-130

Liability A/c in supplier sie: 01-000-2210-0000-000

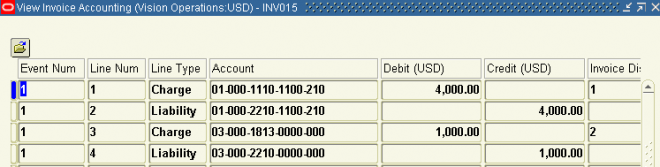

Automatic offset method : Accounting

Invoice is cretaed with two distribution line with differnt balancing segments

Charge A/c with BS1: 01-000-1110-1100-210

Charge A/c with BS2: 03-000-1813-0000-000

Liability A/c in supplier sie: 01-000-2210-0000-000

When Accouting is done the system 'll create the Liability A/C for BS2 by repalcing the natural a/c segment of of the charge A/c in BS2(i.e. 03-000-1813-0000-000) and the A/C would 03-000-2210-0000-000. The complete A/C 'll be

Hi , Thanks a Lot for Such a

Hi , Thanks a Lot for Such a Great Explanation....... It was Really Very Helpful and Explained in Interesting Way Shoaib